Difference between revisions of "Taxes"

From eRepublik Official Wiki

GrzechoooBot (Talk | contribs) (getting rid of eRepublik Rising category) |

(image format fix) |

||

| Line 1: | Line 1: | ||

{{LangMenu}} [[Category:Economy]] | {{LangMenu}} [[Category:Economy]] | ||

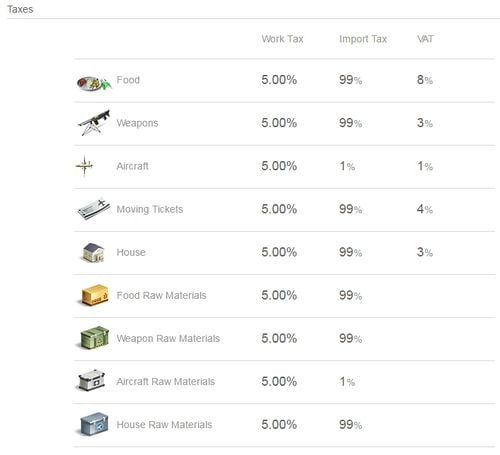

| − | + | [[File:Taxes2.jpg|thumb|right|500px|List of taxes. Each product has three taxes set: Income Tax, Import Tax and Value Added Tax]] | |

== List of Taxes == | == List of Taxes == | ||

Your country's current taxes can be seen on the [[Economy]] page in game. | Your country's current taxes can be seen on the [[Economy]] page in game. | ||

Revision as of 02:52, 12 March 2013

| Languages: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

List of Taxes

Your country's current taxes can be seen on the Economy page in game.

- Income Tax: A tax on employees salary. Income tax is not added to House, Defense System, Hospital as Moving Tickets products and they can no longer be produced.

- Import Tax: A tax on products purchased from a foreign producer .

- VAT: Value added Tax. A tax paid on manufactured goods. VAT is not added to the price of raw materials.

Tax Changes

![]() Changes to Income Tax, Import Tax, and VAT are proposed by Congress members and approved by Congress through voting.

Changes to Income Tax, Import Tax, and VAT are proposed by Congress members and approved by Congress through voting.

- A single law proposal can change taxes only for one industry.

If taxes are set too high, the economy will be affected, as taxpayers will not be able to keep up with the growth. On the the other hand, if taxes are set too low, less money will come from the economic activity, and the country budget will have lower revenues.