Work tax

| Languages: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

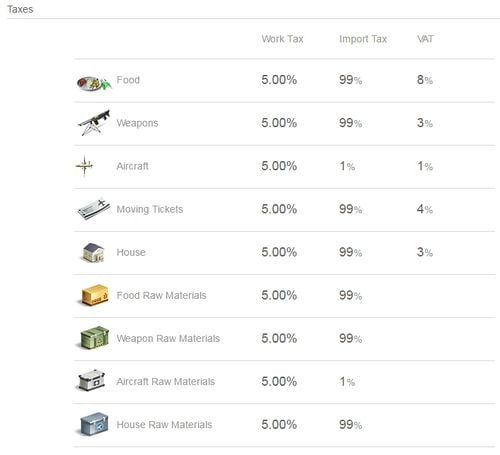

| Work tax is a tax set forth by the country administration that is deducted both from wages received by employees and from citizens working in their own companies as general manager. Work tax is the same for all industries in the country. Work tax is calculated based on the citizenship country. |

Tax rates can be viewed by clicking on the Economy tab on My country.

Tax revenue is added to the treasury.

The work tax replaced the income tax on Day 2,089 of the New World[1].

Taxes when working as an employee

Work tax is taken from the wage that is set by the general manager when the citizen takes a job from the job market and becomes an employee. The tax is calculated after the employee clicks the work button. The tax is paid to the citizenship country of the employee.

- Example

- If an employee has

5 CC wage, and the country work tax is 5%, it means that after working, the employee would receive

5 CC wage, and the country work tax is 5%, it means that after working, the employee would receive  4.75 CC net wage and the work tax value (

4.75 CC net wage and the work tax value ( 0.25 CC) would be added to the treasury.

0.25 CC) would be added to the treasury.

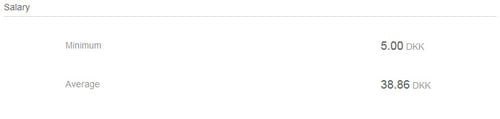

Taxes when working as a general manager

Work tax when working as a general manager is calculated differently. The tax is calculated on work tax percentage multiplied with the average net salary paid in the country. The tax is calculated every time general manager clicks the start production button. If the general manager doesn’t have enough money to pay the Work Tax, he will not be able to start production in his/her companies.

- Example

- The average net salary paid in the last 30 days is

100 CC and the set Work Tax is 10%. In this case, the Work Tax value will be

100 CC and the set Work Tax is 10%. In this case, the Work Tax value will be  10 CC. If a general manager marks 5 companies and clicks on start production, he will pay the Work Tax value multiplied by 5, in this case

10 CC. If a general manager marks 5 companies and clicks on start production, he will pay the Work Tax value multiplied by 5, in this case  50 CC.

50 CC.

Which country gets the tax?

As of day 3145[2], general manager's work tax will be shared between the country where the holding is based and the country of the manager’s citizenship, as follows:

Please note that if both countries are the same, 100 % of the work tax value would be paid in that country's treasury.

- Example

- Work Tax value that general manager needs to pay is

10 CC.

10 CC.

This means that in the treasury of the country where holding is - 8 CC would be paid in.

8 CC would be paid in.

In the treasury of the citizenship country - 2 CC would be paid in.

2 CC would be paid in.

Please note: the amount received by each country will depend based on daily fees. Each country will:

- Pay Taxation of Occupied Regions (if applicable)

- Pay Cities Subsidy

- Pay Dictatorship Upkeep (if applicable)

- Receive the remained in the Treasury